The share market is where you can buy and sell parts of companies, called shares, it’s a fraction of a company’s ownership.

In Malaysia, Bursa Malaysia is our stock exchange. It helps companies raise money, and for investors, it’s a chance to own part of a company and benefit from its success.

If you’re thinking about investing, here’s why the share market is worth considering and what is the beauty of it:

Potential for Long-Term Growth

One of the most attractive aspects of stock market investing is the potential for long-term growth. Historically, stocks have delivered higher returns compared to other asset classes like bonds, savings accounts, or even real estate.

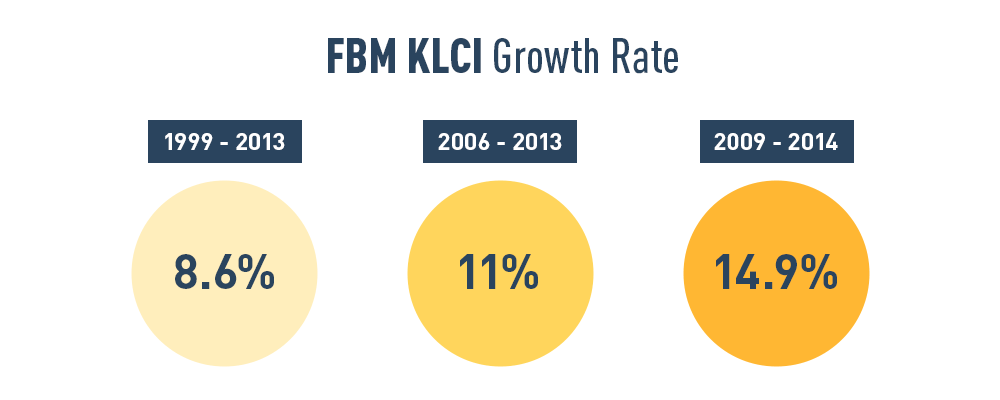

For instance, major stock indexes such as the S&P 500 or our local KLCI index have consistently provided an average annual return that can easily beaten the inflation in long periods.

While there may be short-term market fluctuations, investing in solid companies and holding your investments over time can yield significant gains, helping you build wealth and reach your financial goals.

Hedge Against Inflation

Inflation erodes the purchasing power of money over time, making it harder to maintain your standard of living. If you leave your money sitting in a savings account, it may lose value as inflation rises. Stocks, however, have historically outpaced inflation, helping you preserve and grow your wealth.

Companies can pass rising costs to consumers in the form of higher prices, allowing their revenues and stock values to grow even during inflationary periods. Investing in companies that can adapt to inflationary pressures can protect your financial portfolio from the impact of rising costs.

Accessibility and Ease of Entry

Today, investing in the stock market has become easier than ever. With the rise of online brokerage platforms and mobile apps, you can start investing with as little as a few hundred ringgit.

In the current market, brokers charge minimal fees for online orders, and the total cost is typically less than 1%, including clearing fees and stamp duty. This makes it cost-effective for beginners to build a portfolio without worrying about fees significantly reducing their returns.

Above are fees offered for two different accounts by AmEquities.

Liquidity

Stocks are considered highly liquid investments, meaning they can be quickly bought or sold in the market. This gives you the flexibility to access your money when needed, unlike other assets such as real estate, which can take months to sell.

Liquidity is especially important in times of financial emergencies or when you need to adjust your investment strategy. While long-term investors typically leave their investments in place to maximize growth, the ability to quickly sell stocks when necessary provides peace of mind and flexibility.

Read more about investment and fund allocation planning here

Leave a comment