On the past month I’ve been encountering several questions about YTL’s situation, here’s a wrap on what’s my view on it.

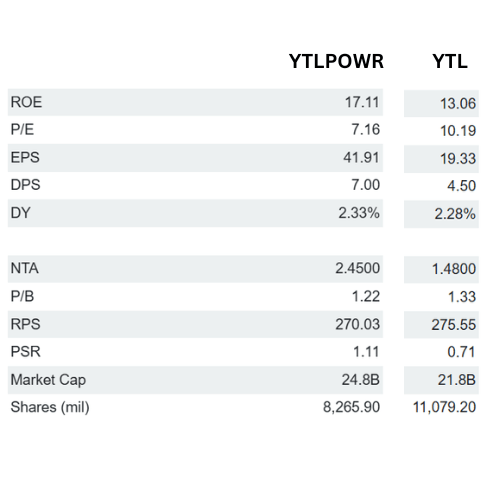

1. Fundamental Analysis

- Revenue Stability: YTL Corporation has shown steady revenue growth, highlighting its strength in core sectors like utilities, construction, and property development.

- Valuation: A favorable P/E ratio suggests YTL might be undervalued compared to competitors, making it an attractive option for value-focused investors.

- Risk Factors: YTL’s performance is influenced by the tech sector (e.g., companies like Nvidia). Market shifts in technology could affect YTL’s stock performance, so this dependency is worth considering.

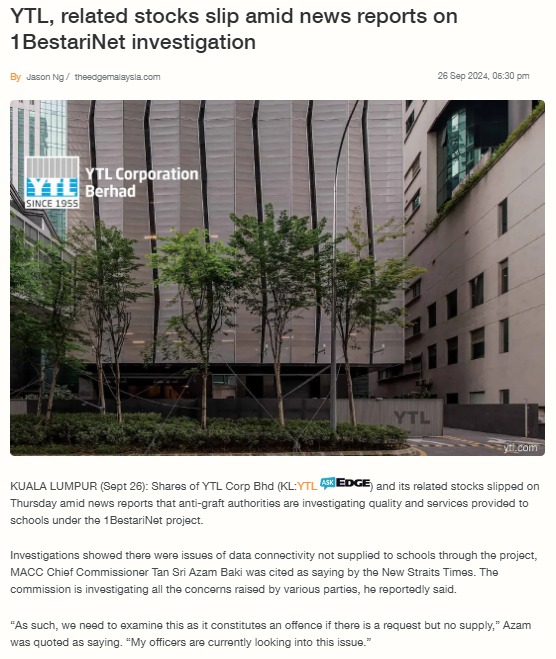

2. Current Situation

- Legal Concerns: YTL’s involvement in a Malaysian Anti-Corruption Commission (MACC) investigation has created uncertainty, which could affect investor confidence and stock stability.

- Market Impact: If legal issues aren’t resolved soon, negative market sentiment could continue to weigh on the stock prices for both YTL and YTL Power.

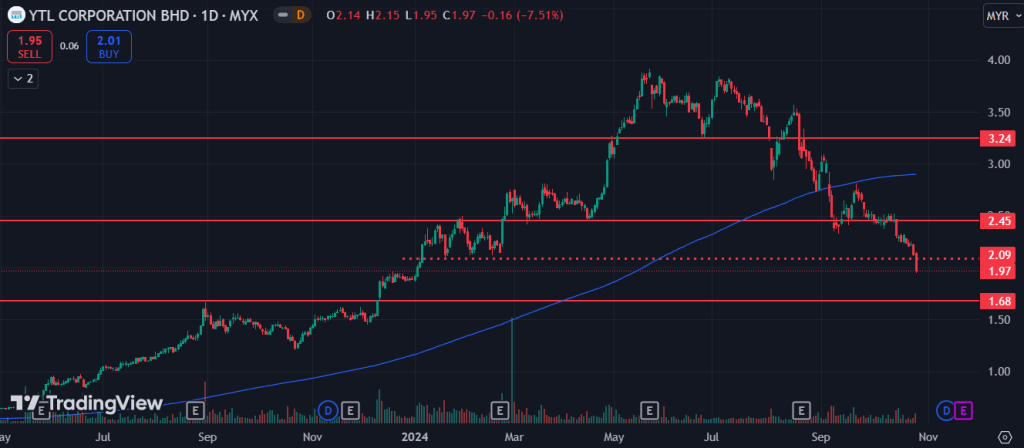

3. Technical Analysis

- Current Trend: YTL and YTLPOWR stocks are in a downtrend, having recently broken key support levels. Without any significant news, the stock may move sideways for 3-6 months as the market corrects its previous over-hyped situation.

- Investor Sentiment: Without positive updates, it’s unlikely there will be strong price appreciation in the near term.

Options for Shareholders

- Average Down or Hold: For those with a long-term outlook and high-risk tolerance, averaging down could be beneficial, especially if you believe in YTL’s fundamentals. But! I would recommend to only make the decision after the price stables, do not try to catch the falling knife.

- Cut Losses: For risk-averse investors, reallocating capital to more stable assets could be a better option amid legal uncertainties and volatile trends.

However, for individuals with losses above 40% (bought at peak), would highly recommend to average down when it comes to sideways, ideally above 1.68 and not dropping further.

Leave a comment