Trading IPO counters is slightly different from trading typical stocks due to several factors, including:

- Limited Historical Data: IPO stocks have little to no historical trading data.

- Polished Fundamentals: The company’s financial ratios may be carefully prepared, which could skew the true picture.

- Hyped Sentiment: IPOs often come with high expectations, making them prone to market hype.

- Early Investor Exits: Private equity funds or early investors may use the IPO as an opportunity to cash out.

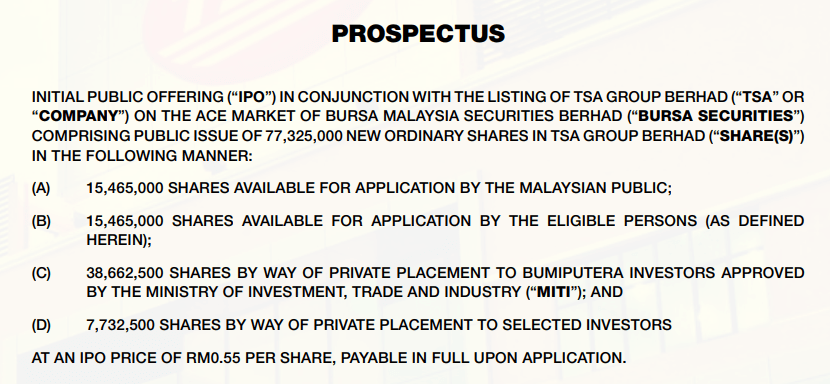

Reading of prospectus can provide you detailed knowledge for the counter itself and understand what the company is planning to do with the funds.

Preparing to Trade an IPO

- Research Similar IPOs

Study similar IPOs in the sector. Prior successful IPOs in a related sector can influence sentiment, while counters in underperforming sectors may struggle on launch day.

Example: Certain sectors tend to perform poorly on their IPO dates. - Understand the IPO’s Purpose

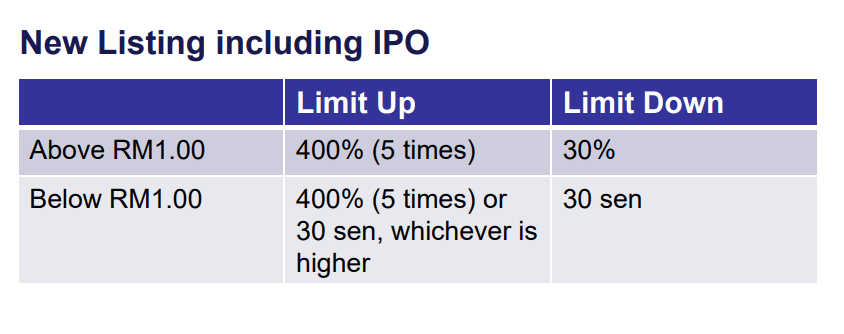

Determine why the company is going public. Is the primary goal to raise funds, or is it an exit strategy for early investors? - Be Aware of IPO Price Limits

IPOs in Malaysia have specific price movement limits:If you plan to buy on the opening day, consider the potential maximum upside and whether the stock’s operator can sustain further gains despite profit-taking pressure.

- Check IPO Issue Price

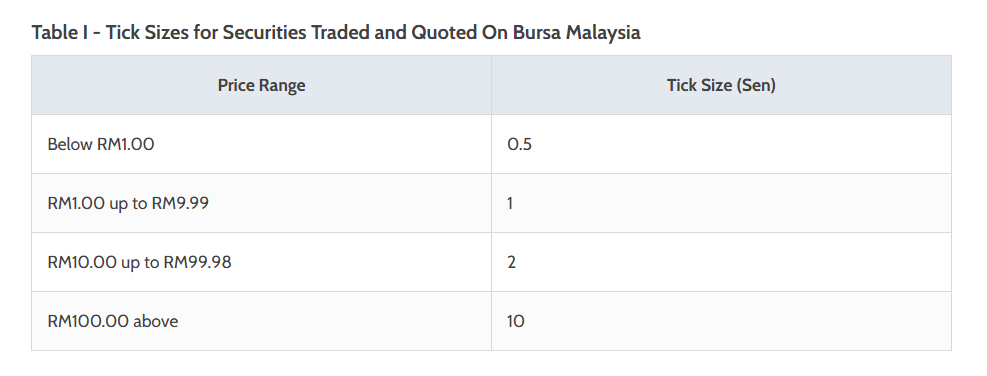

Is the IPO price above or below RM1? Stocks priced below RM1 are typically more volatile due to bid-spread differences.

Homework and highights about trading an IPO

- Gather Early Information

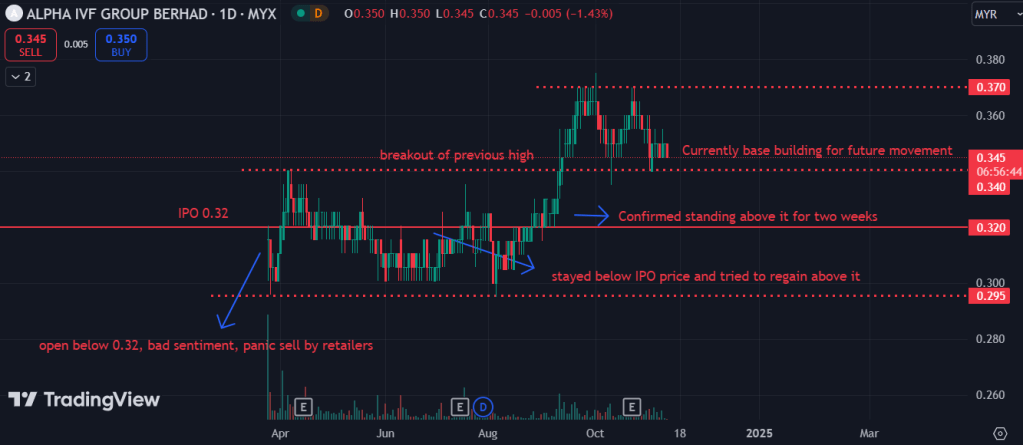

Track key points: IPO issue price, opening price on day one, closing price, and overall movement on the first day. This initial activity offers insights into investor interest and momentum.

IPO historical summary and details can be found at Bursa’s website - Plan Your Entry and Exit

If you decide to buy early, prepare for potential pullbacks as initial hype fades or operators lose momentum. Pre-set a stop-loss point and decide on profit-taking based on your own risk tolerance. - Look for Bargain Opportunities Below IPO Price

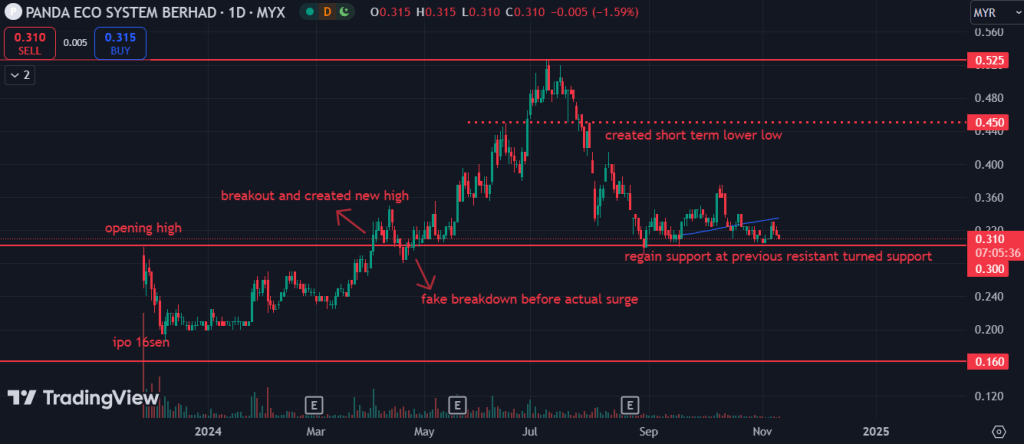

If the stock drops below the IPO price, consider how long it might remain there before a potential surge. An optimal entry can be found if the stock stabilizes below the IPO price, then rises to retest and establish that price as a new support level.

Assessing Scenarios Based on Opening Price

The opening price of an IPO stock in relation to its issue price can set the tone for its early trading behavior. If the IPO opens significantly above or below the issue price, it impacts your ability to gauge entry and exit levels. Here’s how different scenarios could play out:

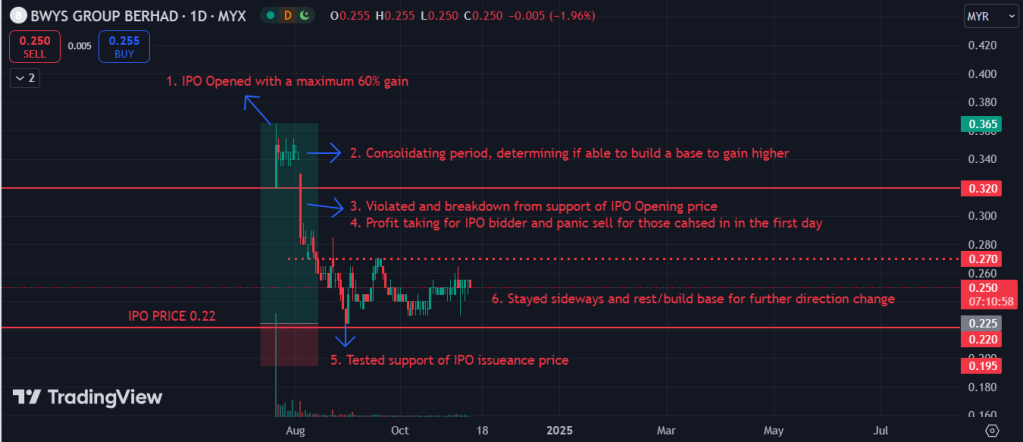

- Scenario 1: Issue Price at RM0.30, Opens at RM0.60

In this case, the stock opens well above its issue price. If it drops below RM0.60, there’s a risk of a free fall, as the next significant support would be the issue price of RM0.30. Avoid entering at this stage, as the downside potential is uncertain and RM0.60 may quickly turn into a strong resistance level. - Scenario 2: Issue Price at RM0.30, Opens Below at RM0.28

If the stock opens below the issue price, RM0.30 becomes the initial resistance level. Avoid entering until the stock can regain RM0.30 and establish it as a support. If RM0.30 holds strong, it may signal stability, making it a better entry point. - Scenario 3: Issue Price at RM0.30, Opens Near at RM0.305

When the stock opens just above the issue price, RM0.30 can act as a support level. For those considering an entry, buying around RM0.30–RM0.305 may be viable, but it’s crucial to set a stop-loss just below this level, such as at RM0.290 (two bids below). This helps manage risk in case the stock doesn’t maintain support at RM0.30.

Fundamental Perspective for Long-Term Investors

If the company has strong fundamentals and you’re willing to invest for the long term, you may choose to hold the stock regardless of its short-term price fluctuations.

However, don’t expect dividends from IPO stocks, as companies typically use IPO proceeds to fund their growth rather than to pay shareholders. If a dividend is offered, it could indicate a deviation from their initial purpose of raising funds.

How Long Will the Spotlight Last?

IPO counters can remain a hot topic even a year after listing. I often consider them “new” for quite some time due to the lack of historical price levels and established trading ranges. Building reliable support and resistance levels takes time, and this initial period can be volatile and uncertain.

Investing in IPOs requires waiting for the stock to establish key price points, build consolidation patterns, and prove itself in the market. Rushing to buy too soon may expose you to unnecessary risks, while holding back allows you to analyze whether the stock is forming strong support zones and upward momentum.

Beware of FOMO (Fear of Missing Out)

The excitement surrounding a new IPO can make it easy to feel the pressure of FOMO. Many investors worry that waiting too long will mean missing out on rapid early gains. However, the initial hype can lead to overvaluation and high volatility, as early investors and private equity holders may quickly sell their shares to lock in profits.

Instead of diving in right away, remember that real value often emerges after the market settles. Exercising patience can help avoid costly mistakes, allowing time to identify strong support levels and ensure the stock isn’t just riding on hype but building genuine strength.

Leave a comment