Recap of the News

The US has announced a new round of tariffs, continuing its trade confrontation primarily with China. These measures aim to counter what Washington sees as unfair trade practices and to bring back a more balanced trading relationship. Tariffs are being framed as a tool to protect domestic industries, especially manufacturing, which many argue has been hollowed out by decades of globalization and outsourcing. The move, unsurprisingly, has drawn strong reactions globally, particularly from China.

(Source: BBC Live Coverage)

Economic Impacts – A Long Time Coming

Looking at the domestic side, it’s been clear from day one that the Trump administration (and now, to an extent, its successors) aimed to reclaim a chunk of the manufacturing market that had shifted overseas. Countries like China and others in the developing world have been exporting to the US with strong competitiveness—driven largely by low labor costs and favorable currency differences.

Trump’s goal? Improve the competitiveness of American manufacturing. But how?

- Lower Costs Domestically: Easier said than done. The USD remains strong, and American labor isn’t cheap.

- Level the Playing Field Through Tariffs: Since the US can’t out-cheap labor costs in Asia or Latin America, tariffs serve as a counterbalance. They raise the cost of imported goods, giving local manufacturers a better shot.

Many foreign markets already impose high tariffs on US goods. Trump’s tariffs are a form of retaliation—and a bold one at that. The bigger idea might be to take that tariff revenue and reinvest it into rebuilding domestic industry. It’s a gamble, and in economic terms, it’s more of a high-risk surgery than a simple policy tweak.

Fiscal policy & Spending tools :How Other Countries Might Respond

Countries hit by these US tariffs—especially major exporters like China, Vietnam, or even EU nations—may retaliate with tariffs of their own. But they can also mirror this fiscal playbook in smarter ways. For instance, if they choose to tax US imports, the revenue can be used to:

- Subsidize key local industries to keep them globally competitive

- Offset consumer price inflation from higher import costs

- Fund digitalization or automation in local manufacturing

- Support export diversification to reduce US dependency

What matters is the ratio and allocation—if done effectively, these countries can minimize the damage from tariffs and even turn the friction into internal modernization.

Business Cycle Implications

The upcoming US GDP reports will be telling. If there’s a downturn, it could confirm what many fear: a looming recession triggered (or accelerated) by this trade policy. We’re entering a sensitive phase of the business cycle. Manufacturing might benefit in theory, but short-term economic pain is all but guaranteed.

China – Market Share Takes a Hit

For China, the impact is significant. The US is one of its top export markets. According to Trading Economics, the US accounted for a major share of China’s outbound trade. Tariffs threaten that flow and can erode the market share of many Chinese firms operating in sectors like electronics, machinery, and consumer goods. The longer these tariffs stay, the more pressure Chinese exporters will face to either find new markets or lower their margins.

Malaysia – Short-Term Pain, Long-Term Patience

Malaysia, like many export-driven economies, finds itself caught in the crossfire of the U.S. tariff strategy. In the short term, expect volatility—especially driven by institutional funds pulling back and retail investors avoiding risk. This wave is largely sentiment-driven, not yet a reflection of deep structural issues. The real story will begin to show up in upcoming quarterly earnings, especially from export-heavy firms in sectors like semiconductors, E&E, and palm oil.

Some companies may benefit if global firms accelerate the shift of production out of China, positioning Malaysia as a lower-risk alternative in the supply chain. But for many others, adapting fast will be critical—those too exposed to U.S.-China friction may face margin pressure or export declines.

On the policy side, Malaysia has opted against retaliatory tariffs. The government, via MITI, confirmed its commitment to free and fair trade, choosing diplomacy over escalation. Prime Minister Anwar Ibrahim emphasized this approach, calling U.S. tariff data “fundamentally flawed,” and announced plans to convene an ASEAN ministerial meeting for a regional strategy.

Behind the scenes, Malaysia is preparing fiscal tools to soften the blow:

- Support measures for key industries impacted by trade shifts

- Engagement through frameworks like TIFA

- Investor-focused initiatives to maintain market confidence

This measured stance—avoiding confrontation while strengthening domestic resilience—could pay off long-term. Malaysia is playing the long game, focusing on positioning rather than retaliation.

Technical Analysis : Indices review

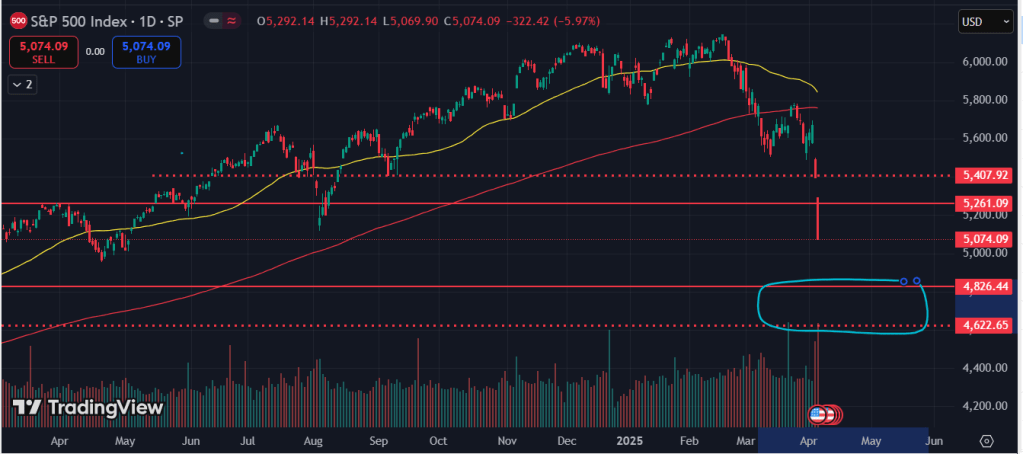

S&P 500 (SPX)

Short-term: Bearish

Mid-term: Uncertain recovery

SPX has taken a sharp dive from its recent highs—levels we haven’t seen since the Covid-era crash. This is a phenomenal correction, and although tempting, buying now could feel like catching a falling knife. Expect continued panic-driven movement, with potential support forming around the 4800–4600 range. Caution is key.

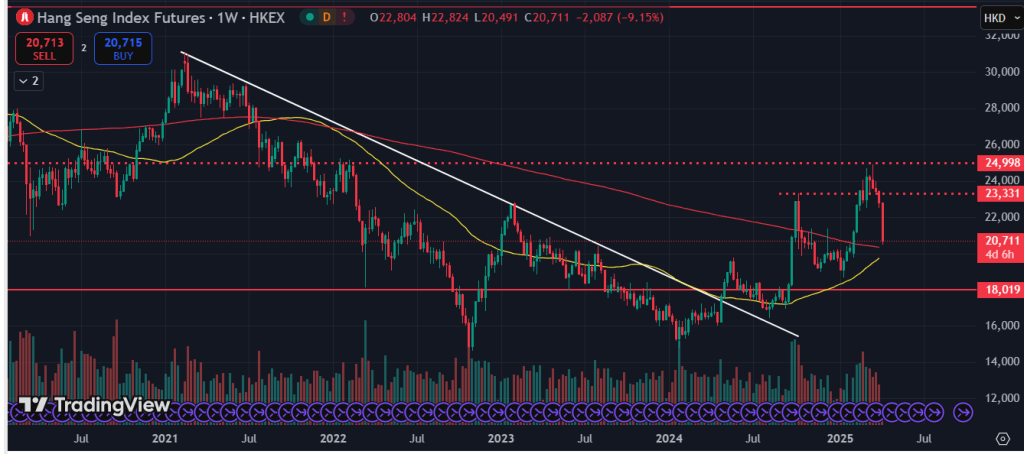

Hang Seng Index (HSI)

Short-term: Highly volatile

Trend: Still sideways

Despite staying within its long-term sideways range, HSI showed significant weakness today, breaking through the 50-day moving average with force. It’s now sliding toward the 200-day MA, hovering around the 20,000 level. Volatility is expected to remain high in the short term.

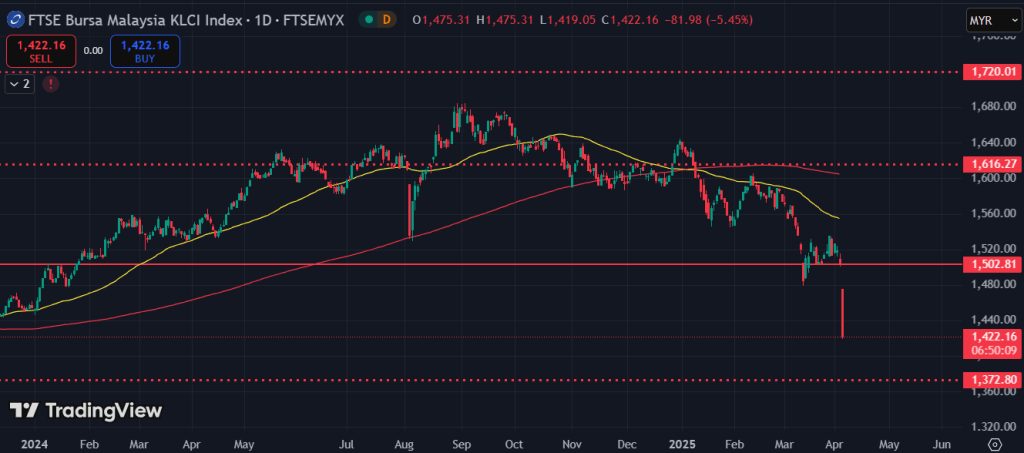

KLCI (Malaysia)

Mid-term: Turning bearish

KLCI is showing clear signs of a trend shift. Both the 50-day and 200-day moving averages are starting to cross—a bearish signal. The index breaking below the 1500 level further confirms mounting selling pressure. A period of consolidation or sideways movement is likely in the coming months as the market digests this selloff.

Leave a comment